Press release -

HMRC warns students of scams

University students taking part-time jobs are at increased risk of falling victim to scams, HM Revenue and Customs (HMRC) is warning.

Higher numbers of students going to university this year means more young people may choose to take on part-time work. Being new to interacting with HMRC and unfamiliar with genuine contact from the department could make them vulnerable to scams.

In the past year almost 1 million people reported scams to HMRC.

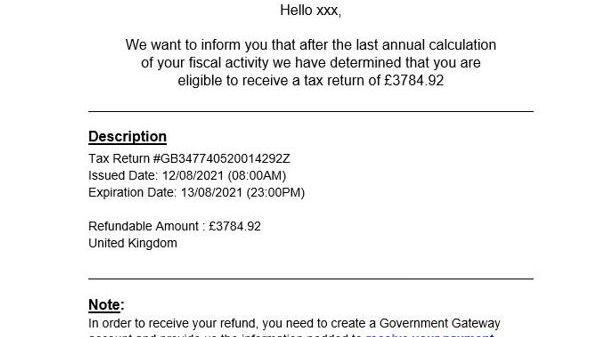

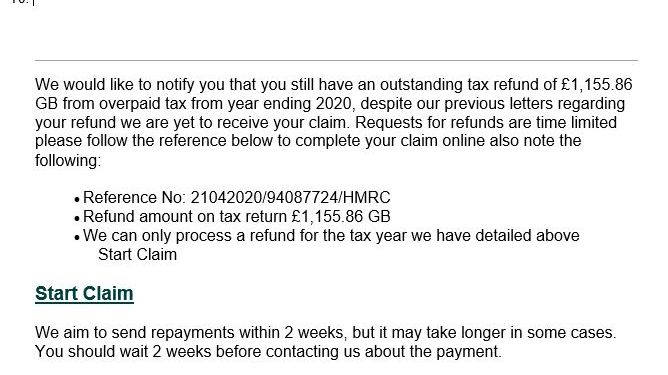

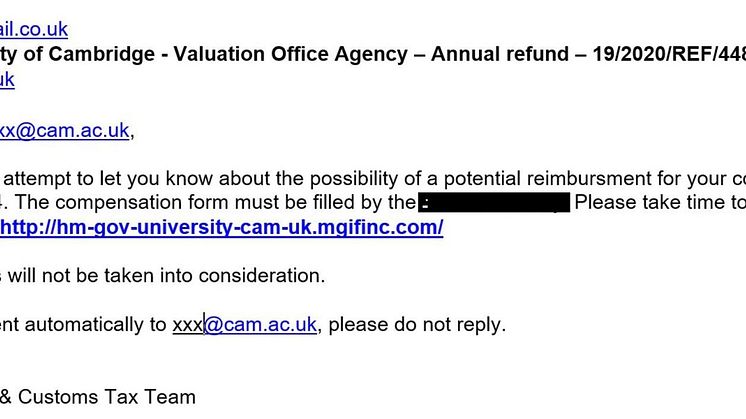

Nearly half of all tax scams offer fake tax refunds, which HMRC does not offer by SMS or email. The criminals involved are usually trying to steal money or personal information to sell on to others. HMRC is a familiar brand, which scammers abuse to add credibility to their scams.

Links or files in emails or texts can also download dangerous software onto a computer or phone. This can then gather personal data or lock the recipient’s machine until they pay a ransom.

Between April and May this year, 18 to 24-year olds reported more than 5,000 phone scams to HMRC.

Mike Fell, Head of Cyber Security Operations at HMRC, said:

“Most students won’t have paid tax before, and so could easily be duped by scam texts, emails or calls either offering a ‘refund’ or demanding unpaid tax.

“Students, who will have had little or no interaction with the tax system might be tricked into clicking on links in such emails or texts.

“Our advice is to be wary if you are contacted out of the blue by someone asking for money or personal information. We see high numbers of fraudsters contacting people claiming to be from HMRC. If in doubt, our advice is – do not reply directly to anything suspicious, but contact HMRC through GOV.UK straight away and search GOV.UK for ‘HMRC scams’.”

In the last year (September 2020 – August 2021) HMRC has:

- responded to 998,485 referrals of suspicious contact from the public. Nearly 440,730 of these offered bogus tax rebates

- worked with the telecoms industry and Ofcom to remove 2,020 phone numbers being used to commit HMRC-related phone scams

- responded to 413,527 reports of phone scams in total, an increase of 92% on the previous year. In April last year we received reports of only 425 phone scams. In August 2021 this had risen to 3,269

- reported 12,705 malicious web pages for takedown

- detected 463 COVID-19-related financial scams since March 2020, most by text message

- asked Internet Service Providers to take down 443 COVID-19-related scam web pages.

By June this year, more than 680,000 students had applied to university, and over 900,000 held part time jobs during the 2020-21 academic year.

Notes to Editors:

1. HMRC’s advice is:

Stop:

* Take a moment to think before parting with your money or information.

* Don’t give out private information or reply to text messages, and don’t

download attachments or click on links in texts or emails you weren’t

expecting.

* Do not trust caller ID on phones. Numbers can be spoofed.

Challenge:

* It’s ok to reject, refuse or ignore any requests – only criminals will try to

rush or panic you.

* Search ‘scams’ on GOV.UK for information on

- how to recognise genuine HMRC contact and

- how to avoid and report scams.

Protect:

* Forward suspicious emails claiming to be from HMRC to

phishing@hmrc.gov.uk and texts to 60599. Report scam phone calls

on GOV.UK.

* Contact your bank immediately if you think you’ve fallen victim to a

scam, and report it to Action Fraud (in Scotland, contact the police on

101).

* Data about student university applications can be found here.

* Data on part-time student employment can be found here.

2. Follow the National Cyber Security Centre’s steps on keeping secure online

at CyberAware.gov.uk.

3. Follow HMRC’s Press Office on Twitter @HMRCpressoffice

Related links

- Identify HMRC related scam phone calls, emails and text messages

- Check a list of genuine HMRC contacts

- Avoid and report internet scams and phishing

- Report suspicious HMRC emails, text messages and phone calls

- Action Fraud

- 2021 CYCLE APPLICANT FIGURES – 30 JUNE DEADLINE

- TBA

- Cyber Aware is the government’s advice on how to stay secure online.

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.