4,800 Self Assessment scams reported

HM Revenue and Customs (HMRC) has issued a warning after more than 4,800 Self Assessment scams have been reported since February 2025.

HM Revenue and Customs (HMRC) has issued a warning after more than 4,800 Self Assessment scams have been reported since February 2025.

HM Revenue and Customs (HMRC) has issued a warning to be on high alert for scams linked to Winter Fuel Payments after receiving 15,100 reports of bogus activity in June.

Parents of 16-19 year olds will receive reminders from HM Revenue and Customs (HMRC) to extend their Child Benefit claim by 31 August if their child is staying in education or training or payments will automatically stop.

Concerned customers reported nearly 150,000 scam referrals to HMRC in the last year, as Self Assessment filers are warned to be alert to fraudsters. With millions due to complete their Self Assessment tax return and pay any tax owed by 31 January 2025, fraudsters are targeting people with offers of tax refunds or demanding payment of tax to get hold of personal information and banking details.

More than a million parents will receive reminders from this week to extend Child Benefit for their teenagers if they are continuing their education or training after their GCSEs or Scottish Nationals.

Around 730,000 tax credits customers will start receiving their annual renewal notices from this week.

With the Self Assessment tax deadline behind us, HM Revenue and Customs (HMRC) is warning people to be wary of bogus tax refund offers. Fraudsters could set their sights on Self Assessment customers, with more than 11.5 million submitting a tax return by last month’s deadline. Taxpayers who completed their tax return for the 2022 to 2023 tax year by the 31 January deadline might be taken in.

During National Apprenticeship Week HM Revenue and Customs (HMRC) is encouraging apprentices to claim the money that is rightfully theirs. Whether that’s making sure you’re being paid the correct hourly rate to claiming the savings in your Child Trust Fund, this is how to do it.

Know your worth

You’ve started an apprenticeship, you’re bringing home a wage, but are you getting paid correct

Self Assessment customers are urged to be on the lookout for scam texts, emails and phone calls from fraudsters.

This warning comes as HM Revenue and Customs (HMRC) received more than 130,000 reports about tax scams in the 12 months to September 2023, of which 58,000 were offering fake tax rebates.

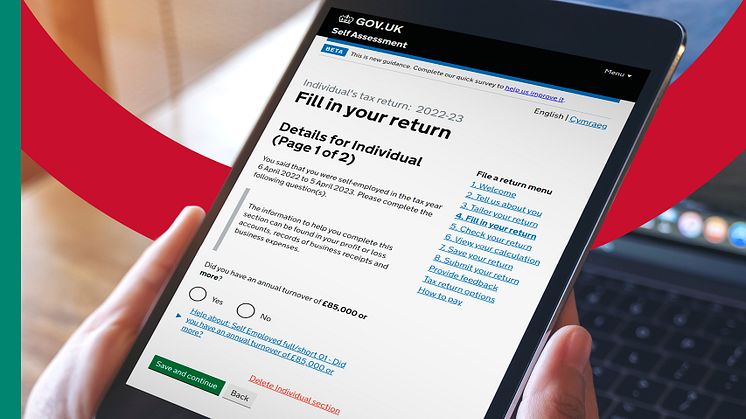

With around 12 million people expected to submit a Self Assessment tax return for the 2022 to

HM Revenue and Customs (HMRC) is reminding anyone who is new to Self Assessment for the 2022 to 2023 tax year that they have just 2 weeks until 5 October to tell HMRC and register.

HMRC has today revealed that more pensioners filed a tax return for the 2020 to 2021 tax year compared to young people.

Self Assessment customers who are starting to think about their annual tax returns for the 2021 to 2022 tax year should guard against being targeted by fraudsters, warns HM Revenue and Customs (HMRC).

In the 12 months to August 2022, HMRC responded to more than 180,000 referrals of suspicious contact from the public, of which almost 81,000 were scams offering fake tax rebates.

Criminals clai

HM Revenue and Customs (HMRC) is warning tax credits customers to be aware of scams and fraudsters who imitate the department in an attempt to steal their personal information or money.

About 2.1 million tax credits customers are expected to renew their annual claims by 31 July 2022 and could be more susceptible to the tactics used by criminals who mimic government messages to make them appear

HM Revenue and Customs (HMRC) is warning Self Assessment customers to be on their guard following the Self Assessment deadline after more than 570,000 scams were reported to HMRC in the last year.

At this time of year, Self Assessment customers are at increased risk of falling victim to scams, even if they don’t mention Self Assessment. They can be taken in by scam texts, emails or calls either

University students taking part-time jobs are at increased risk of falling victim to scams, HM Revenue and Customs (HMRC) is warning.

More than 300,000 tax credits customers have just over one week to renew their claims before the 31 July deadline, HM Revenue and Customs (HMRC) has warned.

As the deadline approaches, customers are being urged not to leave their renewal until the last minute and risk their payments being stopped. The quickest and easiest way to complete a renewal is via GOV.UK. Customers can manage their tax c

HM Revenue and Customs (HMRC) is reminding 440,000 tax credits customers they have one month left to renew their tax credits claims ahead of the 31 July deadline.

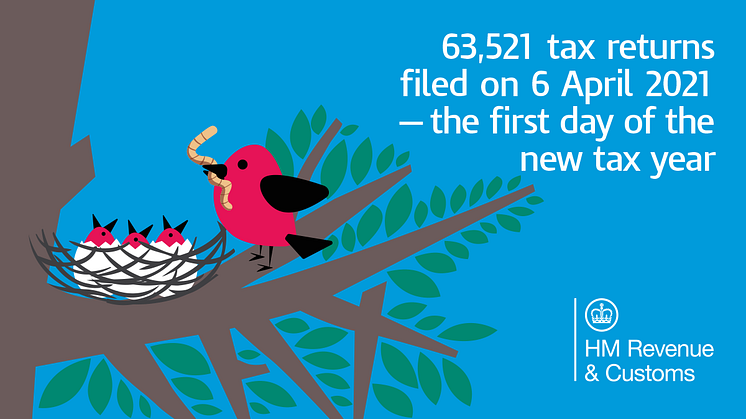

More than 63,500 customers filed their 2020/21 tax return online on 6 April, HM Revenue and Customs (HMRC) has revealed.

HM Revenue and Customs (HMRC) is sending out about 2.5 million annual renewals packs to tax credits customers from this week. Customers should check their details in the renewal pack and report any change in circumstances to HMRC.

Did you know almost 100,000 people filed their tax returns on 6 April 2020, which is the first day of the tax year? With the 31 January deadline fast approaching, HM Revenue and Customs (HMRC) shares some little-known facts about Self Assessment tax returns.