Press release -

£50 million in Self Assessment payments made via the HMRC app

More than 50,000 customers have used the app to make £50 million in Self Assessment payments since February 2022, HM Revenue and Customs (HMRC) has revealed.

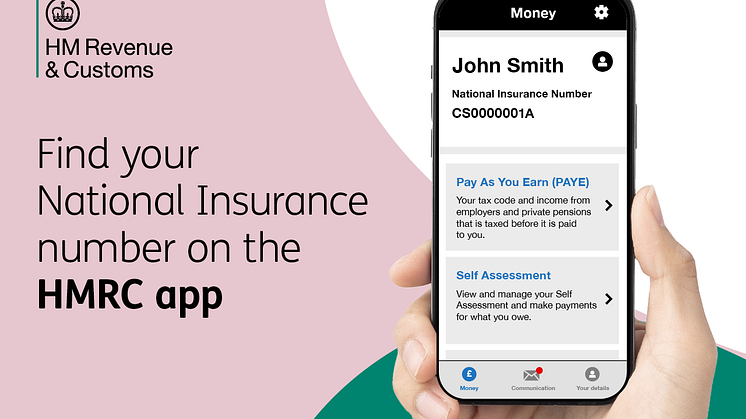

Customers have been able to pay their Self Assessment tax bill via the free and secure HMRC app since February 2022.

Thousands of people are now choosing to use the app to make Self Assessment payments because it is a quick and easy way to manage any tax they owe. In October, more than 6,700 Self Assessment customers paid almost £5.9 million in tax via the HMRC app, compared to around 2,500 customers in February 2022, who paid £1.8 million.

The deadline for customers to complete their tax return for the 2021 to 2022 tax year and pay any tax owed is 31 January 2023.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said:

“We’re seeing more and more people embrace the convenience and flexibility the HMRC app offers. Self-Assessment customers can pay the tax owed through the HMRC app, which is a secure and convenient tool that can be used at a time and place to suit them.

“To find out more search ‘HMRC app’ on GOV.UK.”

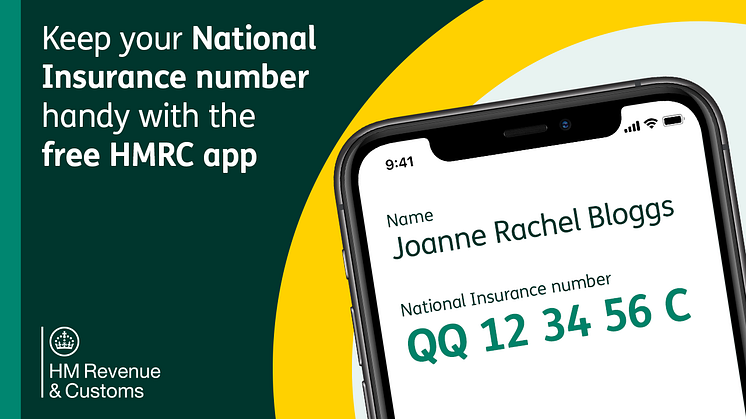

For anyone yet to start their tax return, the HMRC app can also provide information to help complete it including the customer’s Unique Taxpayer Reference (UTR), National Insurance number, information from any PAYE employment for the 2021 to 2022 tax year, or details of any tax credits payments.

App users will need a user ID and password to access their personal information. They can set this up while using the app.

The app’s Self Assessment function is also available in Welsh. Customers can enable Welsh language options from the settings screen.

Self Assessment customers can learn more about the different ways to pay at GOV.UK.

Those who are unable to pay their tax bill in full can access support and advice on GOV.UK. HMRC may be able to help by arranging an affordable payment plan, known as Time to Pay. Customers should try to do this online; go to GOV.UK for more information. Alternatively, they can contact the helpline.

HMRC has a wide range of resources to help customers complete their tax return, including guidance, webinars and YouTube videos.

How do I use the HMRC app to make a Self Assessment payment?

People completing a tax return are at increased risk of falling victim to scams. Check HMRC scams advice on GOV.UK.

Notes to Editors

1. More information about Self Assessment

2. Customers can download the app at the App Storeor Google Play. Online reviews indicate plenty of satisfaction with the app’s performance, as it currently holds a score of 4.8 stars on the App Store, and 4.8 on Google Play.

3. Once a customer has signed into the app for the first time, they can use facial recognition, their fingerprint or a 6-digit pin to get fast and secure access.

4. Customers who don’t have a Government Gateway user ID and password will need two forms of evidence to prove their identity. This can include their UK passport and UK driving licence.

5. We are rolling out a new identity checking alternative, which lets customers use the camera on their phone to confirm a match with their driving licence. We’ll be offering it to more customers during the rest of 2022.

6. We’re urging customers never to share their Government Gateway user ID and password. Someone using these details could steal from them or make a fraudulent claim in their name.

7. If you think you are no longer required to complete an Self Assessment return, you can check if you need to send a Self Assessment tax return.

8. Follow HMRC’s Press Office on Twitter @HMRCpressoffice

Related links

- The free HMRC app

- Pay your Self Assessment tax bill

- If you cannot pay your tax bill on time

- You Tube - How do I use the HMRC app to make a Self Assessment payment?

- Check HMRC scams advice on GOV.UK

- Self Assessment tax returns

- App Store

- Google Play

- Check if you need to send a Self Assessment tax return

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.