Press release -

Scams warning for 12 million Self Assessment customers

Self Assessment customers are urged to be on the lookout for scam texts, emails and phone calls from fraudsters.

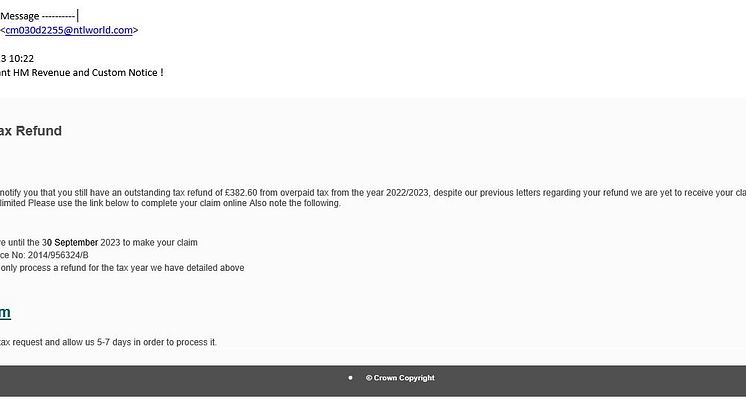

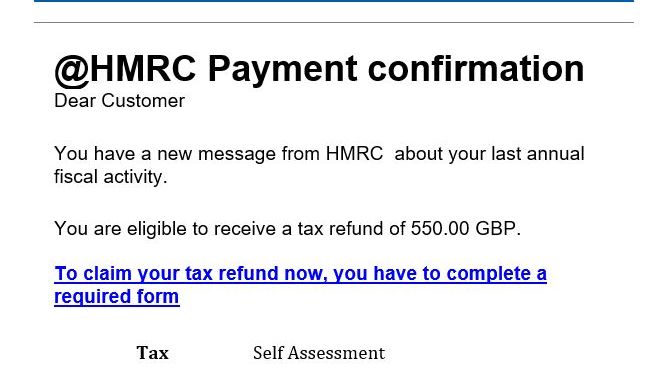

This warning comes as HM Revenue and Customs (HMRC) received more than 130,000 reports about tax scams in the 12 months to September 2023, of which 58,000 were offering fake tax rebates.

With around 12 million people expected to submit a Self Assessment tax return for the 2022 to 2023 tax year before the 31 January 2024 deadline, fraudsters will prey on customers by impersonating HMRC.

The scams take different approaches. Some offer a rebate; others tell customers that they need to update their tax details or threaten immediate arrest for tax evasion.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said:

“HMRC is reminding customers to be wary of approaches by fraudsters in the run up to the Self Assessment deadline. Criminals are great pretenders who try and dupe people by sending emails, phone calls and texts which mimic government messages to make them appear authentic.

“Unexpected contacts like these should set alarm bells ringing, so take your time and check HMRC scams advice on GOV.UK.”

Customers can report any suspicious communications to HMRC:

- forward suspicious texts claiming to be from HMRC to 60599

- forward emails to phishing@hmrc.gov.uk.

- report tax scam phone calls to HMRC on GOV.UK.

HMRC works to protect the public from scammers. In the 12 months to September 2023, HMRC has responded to 60,000 reports of phone scams alone and got 25,000 malicious web pages taken down.

Customers do not need to wait until 31 January before filing their tax return, they can submit it before then but do not have to pay until the deadline, unless they choose to. Filing earlier allows them to find out what they owe sooner or if they are owed money, get their refund.

Help and support is available on GOV.UK to help customers complete their return, there is no need to call us. HMRC has a wide range of online resources to help customers file a tax return including a series of video tutorials on YouTube and help and support guidance on GOV.UK alongside HMRC digital assistant, HMRC app, community forums and the help and support email service.

Notes to Editors

- If customers think they no longer need to complete a Self Assessment tax returnfor the 2022 to 2023 tax year, they should tell HMRC before the deadline on 31 January 2024 to avoid any penalties. HMRC has produced 2 YouTube videos explaining how customers can go online and stop Self Assessment if they are self-employed or are not self-employed.

- The deadlines for tax returns for 2022 to 2023 tax year are 31 October 2023 for paper returns and 31 January 2024 for online returns. The quickest and simplest way to file a tax return is online. Customers who chose to file by paper can find out how to request a paper return via GOV.UK. We no longer automatically issue paper returns unless there’s a reason a customer can’t file online.

- Follow HMRC’s Press Office on Twitter @HMRCpressoffice

Related links

- Report suspicious HMRC emails, text messages and phone calls

- File your tax return early

- Identify tax scam phone calls, emails and text messages

- Help online for Self Assessment

- Starting Self Assessment

- HMRC email updates, videos and webinars for Self Assessment

- Self Assessment tax returns

- Stop being self-employed

- How to go online and stop Self Assessment if you're self-employed

- How to go online and stop Self Assessment if you're not self-employed

- Self Assessment: forms ordering

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.