Child Benefit change: one month to go

High-earning child benefit recipients have a month to decide whether to stop receiving the benefit or to pay a charge on it through Self Assessment.

High-earning child benefit recipients have a month to decide whether to stop receiving the benefit or to pay a charge on it through Self Assessment.

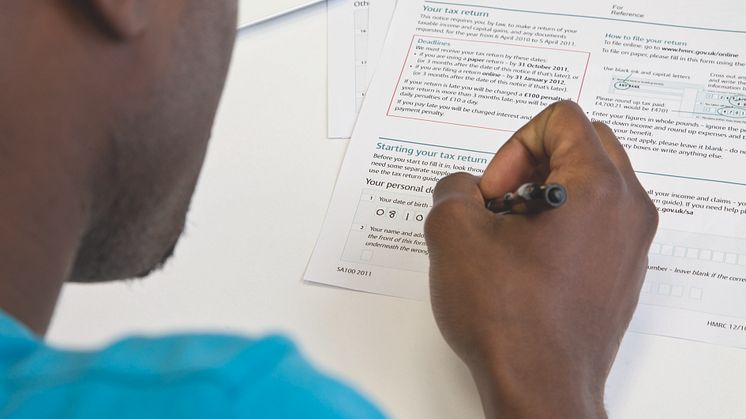

HM Revenue & Customs (HMRC) is issuing a call to all Self Assessment newcomers preparing to send a tax return online for the first time – make sure you register for HMRC’s online services well in advance, so you have plenty of time to file your return.

HM Revenue and Customs (HMRC) has published guidance on penalties for late and inaccurate returns submitted in real time (RTI).

HM Revenue & Customs (HMRC) has produced a video on YouTube explaining the Patent Box, a new tax incentive designed to encourage companies to develop innovative products.

Small and medium-sized companies are being invited to a series of one-day workshops around the country on government support for business R&D and innovation. The free workshops are for SMEs and their professional advisors.

The first taskforces to tackle tax cheats in the rag trade and alcohol industry were launched today by HM Revenue & Customs (HMRC).

A marketed tax avoidance scheme which claimed to license newspaper mastheads to avoid tax has been successfully challenged by HM Revenue and Customs (HMRC) in court.

UK residents with Swiss bank accounts are to be warned that new landmark taxation arrangements are scheduled to come into force on 1 January next year.

The winners of HM Revenue & Customs’ (HMRC) External Engagement Awards 2012 have been announced.

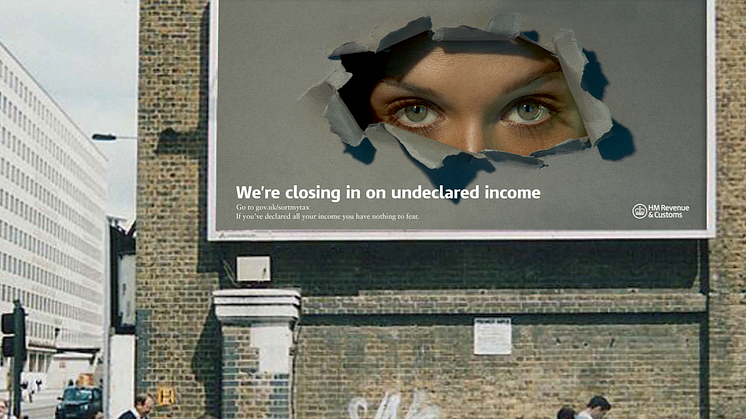

An advertising campaign warning tax cheats to declare all their income before it is too late was launched today by HM Revenue & Customs (HMRC).

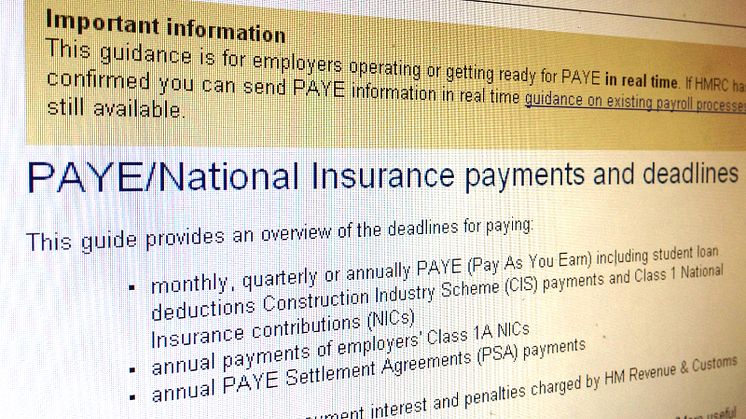

Up to 250,000 employers are set to join the Real Time Information in PAYE (RTI) pilot between now and 31 March 2013.

Business Records Checks are being re-launched by HM Revenue and Customs (HMRC) today, following a review and extensive stakeholder consultation.

If you haven’t yet sent in your 2011/12 tax return, you must send it online if you want to avoid a penalty, as the 31 October deadline for paper returns has now passed.

Mary Aiston, HM Revenue & Customs’ Director of Personal Tax, explains the changes to Child Benefit from January and where to go for help.

Around one million letters will be issued during November to families affected by next year’s changes to Child Benefit.

HM Revenue & Customs (HMRC) has launched a campaign aimed at around 400,000 people involved in direct selling, to help them understand their tax obligations. Marian Wilson head of HMRC Campaigns explains.

Figures released by HM Revenue and Customs (HMRC) today estimate the tax gap for 2010/11 at £32 billion, or 6.7 per cent of tax due, compared to 7.1 per cent in 2009/10.

There are just days left to send your 2011/12 paper tax return to HM Revenue & Customs (HMRC), if you want to beat the 31 October deadline and avoid a penalty.

HM Revenue & Customs (HMRC) is reminding anyone sending their 2011/12 tax return on paper that they need to do so by the 31 October deadline, if they want to avoid a penalty.

HM Revenue & Customs (HMRC) is kicking off its Real Time Information (RTI) awareness campaign next month. This includes writing to over 1.4 million employers.