11.48 million beat the Self Assessment deadline

More than 11.48 million people beat the deadline and filed their Self Assessment tax return for the 2024 to 2025 tax year by 31 January, HM Revenue and Customs (HMRC) can reveal.

More than 11.48 million people beat the deadline and filed their Self Assessment tax return for the 2024 to 2025 tax year by 31 January, HM Revenue and Customs (HMRC) can reveal.

With just over a week until the Self Assessment deadline, 8.6 million people have already filed their return for the 2024 to 2025 tax year. HM Revenue and Customs (HMRC) is urging taxpayers and agents who haven’t filed, to act now or risk missing the 31 January deadline – and face an automatic £100 penalty. More than 11.5 million customers successfully filed by the deadline last year.

More than 4,600 Self Assessment customers filed their tax return on Christmas Day. In total, 37,435 customers filed between Christmas Eve and Boxing Day, suggesting that for some, festive filing is becoming as much a tradition as watching the King's Speech (or avoiding the washing up).

HM Revenue and Customs (HMRC) is encouraging families to start financial discussions and use the HMRC app during Talk Money Week (3 to 7 November) as it reveals its most popular app services.

More than 3.5 million people have already filed their Self Assessment tax return for the 2024 to 2025 tax year and with 100 days to the 31 January 2026 deadline, HM Revenue and Customs (HMRC) is reminding those yet to file to do it early.

A record nearly 300,000 people have filed their tax return in the first week of the new tax year, almost 10 months ahead of the deadline, HM Revenue and Customs (HMRC) has revealed.

As Valentine's Day approaches, anyone who has turned the love for their hobby into a side hustle is being encouraged to 'put a ring on it' and make it official. Whether it’s making extra income from activities such as online content creation, dog walking, or making handcrafted items to sell, HMRC has launched a new campaign to assist people in understanding if they need to declare earnings.

With only a week left until the Self Assessment deadline 3.4 million customers are yet to file their 2023 to 2024 tax return. And HM Revenue and Customs (HMRC) is warning them to file now or risk missing the 31 January deadline – and getting a £100 penalty.

With less than a month to go, the countdown is on for 5.4 million customers who still need to complete and pay their Self Assessment and avoid penalties, HM Revenue and Customs (HMRC) warns. Thousands of taxpayers have already done so by completing their tax returns before the fizz was barely flat on New Year’s Day. HMRC can today reveal more than 24,800 people filed on 1 January.

Concerned customers reported nearly 150,000 scam referrals to HMRC in the last year, as Self Assessment filers are warned to be alert to fraudsters. With millions due to complete their Self Assessment tax return and pay any tax owed by 31 January 2025, fraudsters are targeting people with offers of tax refunds or demanding payment of tax to get hold of personal information and banking details.

This Talk Money Week (4 – 8 November), taxpayers are being urged to “Do One Thing” and get on the HMRC app to save time and simplify managing their money and tax. More than 1.7m people are already using the HMRC app every month, which enables users to access services such as making a Child Benefit claim, finding your National Insurance number and a tax calculator to estimate your take-home pay.

HM Revenue and Customs (HMRC) reveals the top 5 reasons why people are calling the Self Assessment helpline and reminds them that they can self-serve to quickly access the information online.

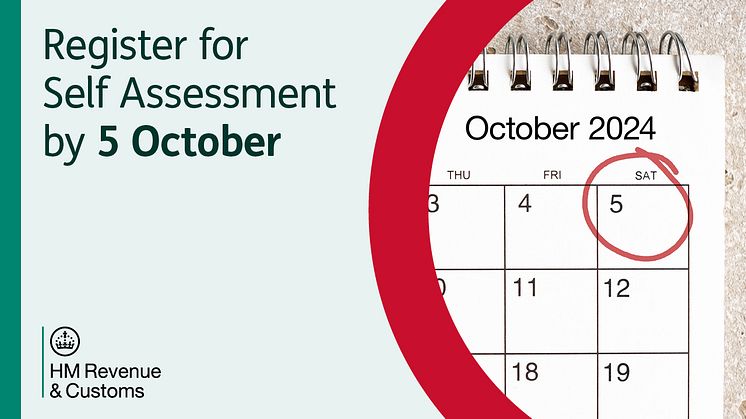

Anyone who needs to complete a Self Assessment tax return for the first time to cover the 2023 to 2024 tax year, should tell HM Revenue and Customs (HMRC) by 5 October 2024. There’s plenty of myths about who needs to file a Self Assessment return before the 31 January 2025 deadline and HMRC today debunks some of the most common ones. Myth 1: “HMRC hasn’t been in touch, so I don’t need to file"

With the Self Assessment tax deadline behind us, HM Revenue and Customs (HMRC) is warning people to be wary of bogus tax refund offers. Fraudsters could set their sights on Self Assessment customers, with more than 11.5 million submitting a tax return by last month’s deadline. Taxpayers who completed their tax return for the 2022 to 2023 tax year by the 31 January deadline might be taken in.

There were 4,757 customers who filed their Self Assessment tax return on Christmas Day, HM Revenue and Customs (HMRC) has revealed.

A day traditionally dominated by eating, drinking, and exchanging gifts saw a perhaps surprising number of customers also find time to go online and complete the essential job of filing their tax return for the 2022 to 2023 tax year, ahead of the 31 January 2024

With Christmas celebrations on the horizon, HM Revenue and Customs (HMRC) has been filming with Santa to encourage customers to tick their tax return off their to do list before his annual visit on Sunday night.

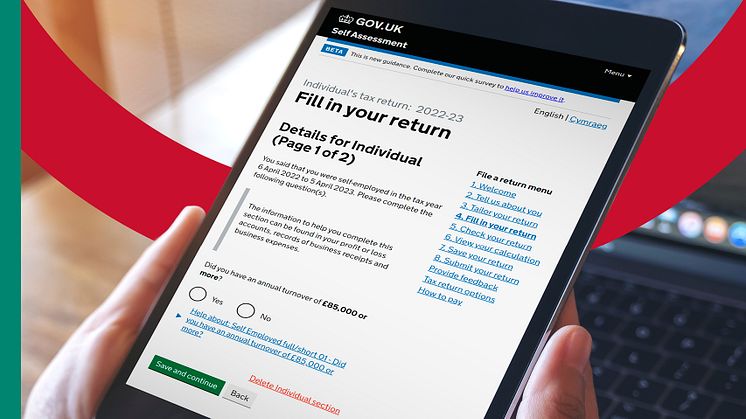

Nobody enjoys having to wait on hold on the phone just to resolve a simple query - and those completing Self Assessment tax returns no longer need to, with more help and advice than ever before available online.

Self Assessment customers could take advantage of four key benefits when filing their tax return early, HM Revenue and Customs (HMRC) has revealed.

Almost 100,000 Self Assessment customers have used online payment plans to spread the cost of their tax bill into manageable monthly instalments since April 2021, HM Revenue and Customs (HMRC) has revealed.

HM Revenue and Customs (HMRC) is waiving late filing and late payment penalties for Self Assessment taxpayers for one month – giving them extra time, if they need it, to complete their 2020/21 tax return and pay any tax due.