Press release -

Scams warning as Self Assessment deadline looms

- HM Revenue and Customs (HMRC) warns of scam attempts targeting Self Assessment customers

- Customers urged to be cautious of refund scams as the 31 January tax return deadline draws closer

Concerned customers reported nearly 150,000 scam referrals to HMRC in the last year, as Self Assessment filers are warned to be alert to fraudsters.

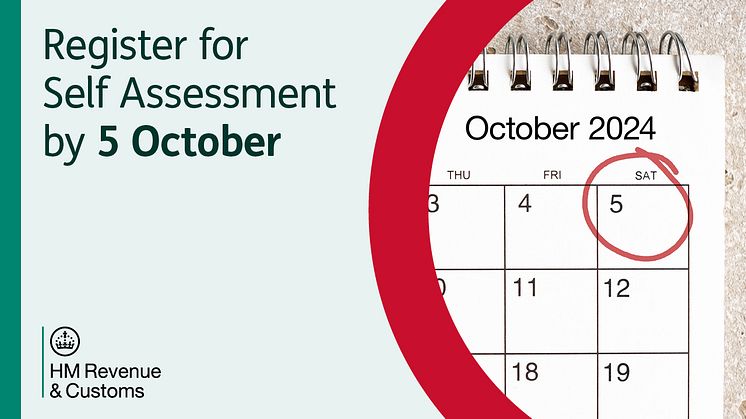

With millions of people due to complete their Self Assessment tax return and pay any tax owed by 31 January 2025, fraudsters are targeting people with offers of tax refunds or demanding payment of tax to get hold of personal information and banking details. Around half of all scam reports (71,832) in the last year were fake tax rebate claims.

There has been a 16.7% increase in all scam referrals to HMRC – 144,298 were received between November 2023 and October 2024, up from 123,596 in the previous 12-month period.

If someone receives communication claiming to be from HMRC that asks for their personal information or is offering a tax rebate, check the advice on GOV.UK to help identify if it is scam activity.

HMRC will never leave voicemails threatening legal action or arrest, or ask for personal or financial information over text message – only fraudsters and criminals will do that.

Kelly Paterson, Chief Security Officer at HMRC, said:

“With millions of people filing their Self Assessment return before January’s deadline, we’re warning everyone to be wary of emails promising tax refunds.

“Being vigilant helps you spot potential scams. And reporting anything suspicious helps us stop criminal activity and to protect you and others who could have received similar bogus communication.

“Our advice remains unchanged. Don’t rush into anything, take your time and check ‘HMRC scams advice’ on GOV.UK.”

HMRC will not contact you by email, text, or phone to announce a refund or ask you to request one. Anyone who is due a refund from HMRC can claim it via their online HMRC account or the free and secure HMRC app.

You can report any phishing attempts to HMRC by:

- forwarding emails to phishing@hmrc.gov.uk

- reporting tax scam phone calls to HMRC on GOV.UK

- forwarding suspicious texts claiming to be from HMRC to 60599

Notes to Editors

- More information about Self Assessment

- HMRC is encouraging customers to be prepared and have all the information they need ready to file their Self Assessment tax returns early, so they can avoid any last-minute stress and know what they owe sooner. HMRC has a range of online help and support and YouTube videos to assist anyone completing their return, including first-time filers.

- Scams advice from HMRC. Remember to:

Protect

- Criminals are cunning – protect your information

- Take a moment to think before parting with your money or information

- Use strong and different passwords on all your accounts so criminals are less able to target you

Recognise

- If a phone call, text or email is suspicious or unexpected, don’t give out private information or reply, and don’t download attachments or click on links

- Check on GOV.UK that the contact is genuinely from HMRC

- Do not trust caller ID on phones. Numbers can be spoofed

Report

- If you’re unsure about a text claiming to be from HMRC forward it to 60599, or an email to phishing@hmrc.gov.uk. Report a tax scam phone call on GOV.UK

- Contact your bank immediately if you’ve had money stolen and report it to Action Fraud. In Scotland, contact police on 101

- By reporting phishing emails, you help stop criminal activity and prevent other people falling victim

4. The government launched its national campaign ‘Stop! Think Fraud’ earlier this year. Backed by organisations across law enforcement, tech, banking, telecoms and the third sector, a new website was created with advice on how to stay safe online. It can be found at www.gov.uk/stopthinkfraud

5. Follow HMRC's Press Office on X @HMRCpressoffice

Related links

- Identify tax scam phone calls, emails and text messages

- Download the HMRC app

- Report suspicious HMRC emails, text messages and phone calls

- Self Assessment tax returns

- Help online for Self Assessment

- Self Assessment YouTube videos

- HMRC phishing and scams: detailed information

- Action Fraud

- HMRC Press Office X account

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.