Press release -

It’s a Self Assessment wrap for 40,000 festive filers

- 4,409 Self Assessment customers completed their tax return on Christmas Day

- 40,072 filed their tax return over the Christmas break

- Customers encouraged to prepare and file their tax return ahead of January deadline

More than 4,400 Self Assessment customers avoided peeling the sprouts to file their tax return online on Christmas Day, HM Revenue and Customs (HMRC) can reveal.

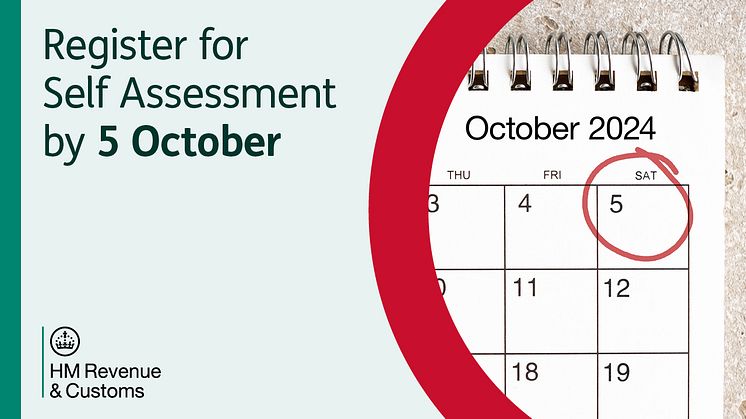

In total, 40,072 customers, as well as spending the 3-day holiday indulging in usual Christmas pastimes of eating, drinking and watching festive favourites on the TV, found time to go online and wrap up their 2023 to 2024 tax return, well ahead of the 31 January deadline.

Festive filing statistics show that over Christmas Eve, Christmas Day and Boxing Day:

- 15:00 to 15:59 proved to be the most popular time to file on the big day itself, with 368 filing their return

- 11,932 customers missed out on leftovers for lunch, submitting their tax return on Boxing Day, with the most popular time being 16:00 to 16:59 and 1,108 filing during that time.

- 23,731 filed on Christmas Eve instead of last-minute shopping and wrapping. The most popular time was 11:00 to 11:59 when 3,458 filed their tax return

Myrtle Lloyd, HMRC’s Director General for Customer Services, said:

“People who need to file a Self Assessment return and already have can enjoy the rest of the festive period knowing they’ve got it wrapped up for another year, and can enjoy singing Auld Lang Syne knowing their tax affairs are in order. For those who haven’t started yet, our online service is available 365 days a year so there’s still a chance to get it done before 2024 is out! Go to GOV.UK and search ‘Self Assessment’ to access the online help and start today.”

Customers who have already submitted their tax return online have until the 31 January 2025 to pay the tax they owe. Those who file before 30 December may have the option of paying any tax owed through their PAYE tax code.

The quickest and easiest way to pay a Self Assessment tax bill is via the HMRC app. For a full list of ways to pay, visit GOV.UK.

For anyone who is yet to start their Self Assessment, there’s plenty of information and guidance online, including YouTube videos, to help people complete their return.

Anyone who regularly sells goods or provides a service through an online platform can find out more about selling online and paying taxes on GOV.UK. The information will help them decide if their activity should be treated as a trade and if they need to complete a Self Assessment tax return.

You may need to file a return if you:

- are newly self-employed and have earned gross income over £1,000

- earned below £1,000 and wish to pay Class 2 National Insurance Contributions voluntarily to protect their entitlement to State Pension and certain benefits

- are a new partner in a business partnership

- have received any untaxed income over £2,500

- receive Child Benefit payments and need to pay the High Income Child Benefit Charge because they or their partner earned more than £50,000

Criminals use emails, phone calls and texts to try to steal information and money from taxpayers. Customers can find more information on how to identify a scam and access a checklist to help them decide if the contact they have received is a scam, on GOV.UK.

Notes to Editors

1. More information on Self Assessment

2. More than 97% of Self Assessment returns are filed online.

3. HMRC has lots of information and support available online which includes:

- HMRC’s digital assistant - the assistant will help you find information, and if you can’t find what you’re looking for you can ask to speak to an adviser. You can also access the digital assistant via the HMRC app.

- guidance notes and help sheets and YouTube videos provide a wealth of information if you’re stuck or confused.

- live webinars where you can ask questions or if you can’t join, you can watch recorded webinars on demand.

- technical support for HMRC online services for help signing into online services.

- email updates - sign up to HMRC email updates so you don’t miss out on the latest information on Self Assessment.

- social media updates - follow HMRC X (formerly Twitter) @HMRCcustomers to get the latest updates on Self Assessment services and useful reminders.

- if you need extra support to help your with Self Assessment you can contact a voluntary or community sector organisation who can provide you with help and advice, or you can get support directly from HMRC.

4. People can use the HMRC app to find out how to register for Self Assessment, check their Unique Taxpayer Reference, get their National Insurance number and employment income and history and pay their tax bill.

5. Follow HMRC’s Press Office on X @HMRCpressoffice

Related links

- Download the HMRC app

- Pay your Self Assessment tax bill

- HMRC email updates, videos and webinars for Self Assessment

- YouTube:Self Assessment tax return

- Check if you need to tell HMRC about your income from online platforms

- Identify tax scam phone calls, emails and text messages

- Self Assessment tax returns

- Ask HMRC online

- Self Assessment tax return forms

- YouTube: Starting Self Assessment

- Technical support with HMRC online services

- Help and support email service

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.