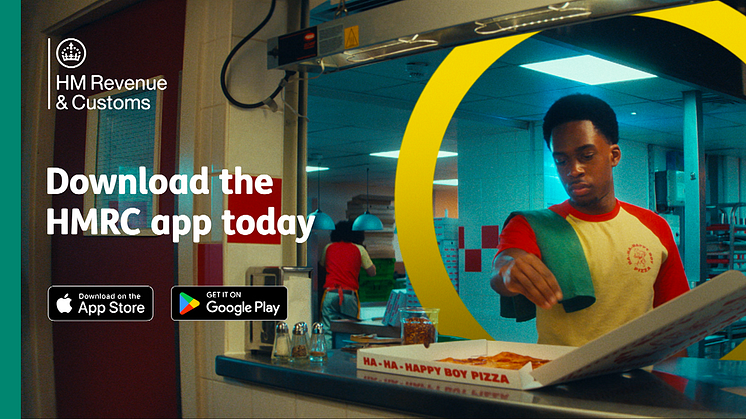

New figures reveal 7 million started a new job in 2025

HM Revenue and Customs (HMRC) has revealed more than 7 million people started a new job in 2025. And as National Careers Week is under way, it is reminding those starting a new job in 2026 to download the HMRC app for their essential tax and employment details.