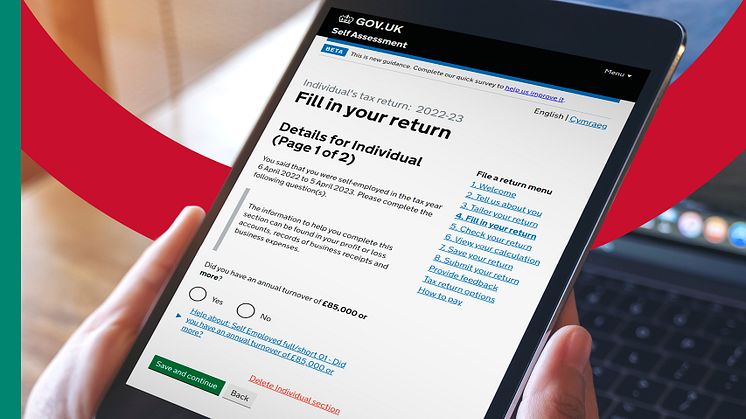

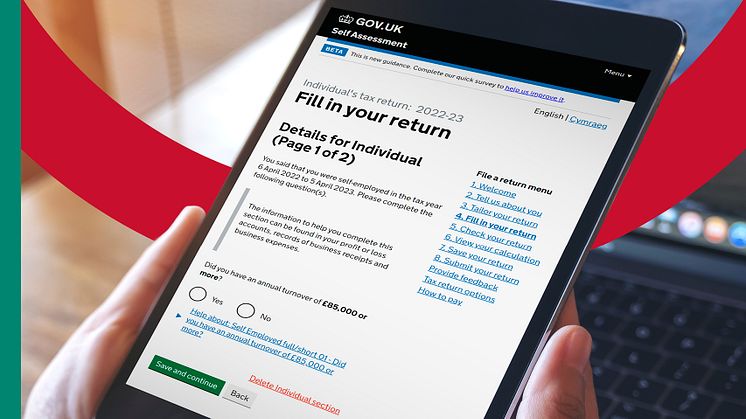

Marriage Allowance: find out if you could be better off in just 30 seconds

Couples who are married or in a civil partnership are being urged by HM Revenue and Customs (HMRC) to spend just 30 seconds to see if they can claim Marriage Allowance and boost their finances by up to £252 a year.