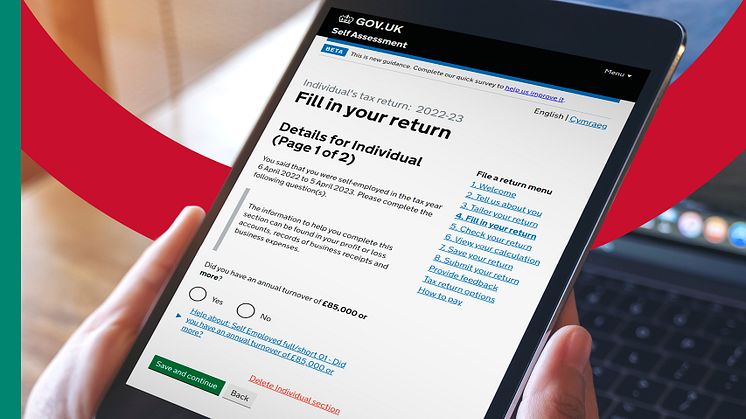

No frosty surprises when you claim tax relief directly with HMRC

Every penny counts at Christmas and employees eligible to claim a tax refund on any work-related expenses are being urged to do it directly through HM Revenue and Customs (HMRC) to guarantee receiving 100% of their claim.

Whether working in hospitality or retail, taking on a seasonal second job as a delivery driver, or even becoming Santa’s elf for the month, the most straightforward way to cl