Press release -

HMRC app: Two million new ‘appy users in 2024

- HMRC’s 2024 review of its HMRC app: 2 million new users, 100 million sessions and £652 million in Self Assessment payments

- Download and access the HMRC app 24/7 to get personal tax information, National Insurance, and Child Benefit.

2024 has been the most successful year for the HMRC app to date, with 2 million more people able to easily check their tax codes, view annual tax summaries and make or receive secure payments – all with just a few taps.

Since its launch in December 2017, more than 7 million people have downloaded the app, and successfully logged in to access their tax information.

Many people are choosing the HMRC app to ‘get on it’ with their money and tax as they start their day with 09:00 to 09:59 the most popular time for customer logins. Over the past 12 months, the increased use of the HMRC app has resulted in:

- more than 100 million app sessions

- more than 2 million new users this year

- £652 million received in Self Assessment payments

- 77% increase in app downloads in 16-25 age group

- consistently in top spot in the app finance charts

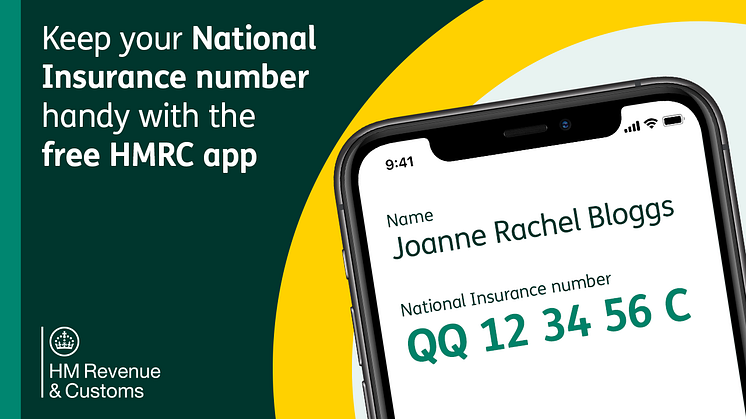

HMRC is encouraging anyone not already using the free and secure HMRC app to download it from the App Store or Google Play today. People can access their personal tax information whenever or wherever they need it and even save their National Insurance number to their digital wallet.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said:

“The HMRC app is a great tool to access your National Insurance number, claim Child Benefit or pay your Self Assessment tax bill on the go. There are lots of services available through the app which can save you a phone call and get you an answer quickly and easily. So why not join the 2 million new users who have downloaded the app this year?”

In November, HMRC launched a promotional campaign for the app to encourage 18-34 year olds to download the app. Watch the video on YouTube ‘You’re on it’.

The Treasury Select Committee recently heard from First Permanent Secretary and CEO of HMRC, Jim Harra about the recent app promotion:

“We’re running a campaign for 18-34 year olds as they’re an important audience for us, but they’re often students getting Christmas jobs. We see a real spike in calls from this demographic ringing us to ask for their National Insurance number at this time of year, something which is readily available on the app, so we want to encourage them to use the app for this.”

Notes to Editors

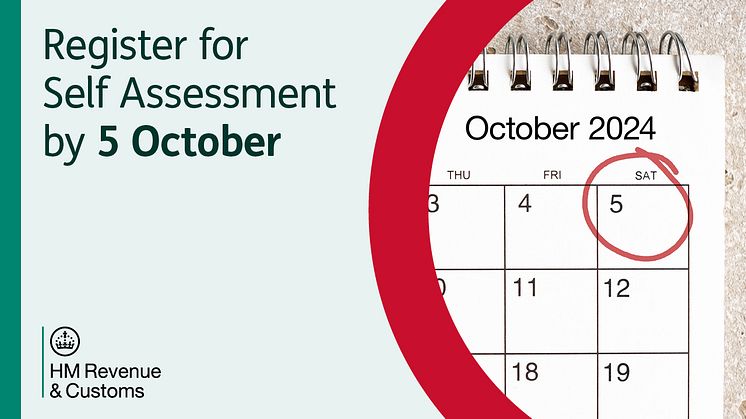

- How to register and setup HMRC online services or set up an account use the app

- Download the app and read the customer reviews from the App Store (4.8 out of 5) and Google Play (4.7 out of 5)

- You can use the HMRC app to:

- check your tax code, National Insurance number, and income and employment history from the past five years

- view and manage Child Benefit, Tax Credits, and your State Pension forecast

- access tax details, including your Unique Taxpayer Reference and income information

- use tools like the tax calculator to estimate take-home pay, and check for National Insurance contribution gaps

- make payments for Self Assessment, Simple Assessment, and even set payment reminders access your Help to Save account and claim refunds if you have overpaid tax

- track forms and correspondence with HMRC

- update personal information like your name and address

- save your National Insurance number to a digital wallet and opt for electronic communications from HMRC

- use HMRC’s digital assistant for guidance and support

- Follow HMRC’s Press Office on X @HMRCpressoffice

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.