Walking the halls of history with History Alice: PAYE at 80

History Alice visits HMRC to find out more about the introduction of Pay As You Earn, 80 years ago.

History Alice visits HMRC to find out more about the introduction of Pay As You Earn, 80 years ago.

4,409 Self Assessment customers completed their tax return on Christmas Day

40,072 filed their tax return over the Christmas break

Customers encouraged to prepare and file their tax return ahead of January deadline

More than 4,400 Self Assessment customers avoided peeling the sprouts to file their tax return online on Christmas Day, HM Revenue and Customs (HMRC) can r

A fugitive fraudster who stole more than £750,000 in a tax and mortgage fraud faces an extra five years in prison for not paying back the money.

HMRC’s 2024 review of its HMRC app: 2 million new users, 100 million sessions and £652 million in Self Assessment payments Download and access the HMRC app 24/7 to get personal tax information, National Insurance, and Child Benefit.

2024 has been the most successful year for the HMRC app to date, with 2 million more people able to easily check their tax codes, view a

More than one million parents have claimed online or via the HMRC app since new digital service launched

New parents who claim Child Benefit online could get their first payment before Christmas

87% of new Child Benefit claims are made online

HM Revenue and Customs (HMRC) reveals more than one million families have claimed Child Benefit using the new digital service launched earlier this year

Self Assessment customers unable to pay their tax bill in full by 31 January 2025 can spread the cost using HMRC’s online Time to Pay system Time to Pay plans support those who cannot pay their tax bills on time by arranging regular monthly payments in return for avoiding any further late payment penalties Online payment plans can be set up for tax bills up to £30,000, without the need to conta

Running a small business, working for yourself, or considering self-employment?

HMRC’s free online guidance and interactive tools can help you understand your tax responsibilities.

As Small Business Saturday approaches, HM Revenue and Customs (HMRC) has launched a new interactive online tool and clearer guidance for people working for themselves and individuals considering self-employment.

People selling unwanted items online can continue to do so with confidence and without any new tax obligations, HM Revenue and Customs (HMRC) has confirmed. The reminder comes as online platforms start sharing sales data with HMRC from January 2025 – a new process that, when announced last year, generated inaccurate claims that a new tax was being introduced.

A former accountant of a national children’s charity has been jailed for 10 years for using his knowledge of the sector to steal £1.5 million through fraudulent Gift Aid claims.

A sacked HM Revenue and Customs (HMRC) officer who abused her position to help her husband launder £3.3 million of criminal cash has been sentenced.

A tax fugitive who was on the run for nearly three years, was finally caught when he ordered a kebab to his hideout.

Concerned customers reported nearly 150,000 scam referrals to HMRC in the last year, as Self Assessment filers are warned to be alert to fraudsters. With millions due to complete their Self Assessment tax return and pay any tax owed by 31 January 2025, fraudsters are targeting people with offers of tax refunds or demanding payment of tax to get hold of personal information and banking details.

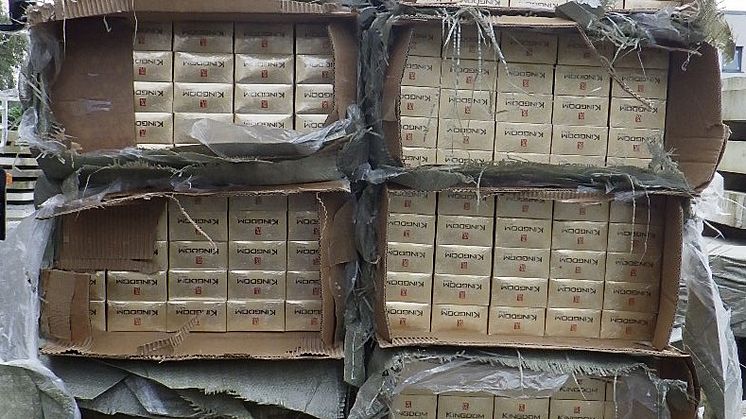

A smuggling gang caught complaining about the seizure of millions of cigarettes on an encrypted phone network have been jailed.

Four men have been arrested after the seizure of more than 11 million cigarettes in South Armagh.

This Talk Money Week (4 – 8 November), taxpayers are being urged to “Do One Thing” and get on the HMRC app to save time and simplify managing their money and tax. More than 1.7m people are already using the HMRC app every month, which enables users to access services such as making a Child Benefit claim, finding your National Insurance number and a tax calculator to estimate your take-home pay.

Here are some top tips for tax agents ahead of the Self Assessment (SA) deadline on 31 January 2025.

People have 100 days until 31 January deadline to file their Self Assessment tax return and pay tax owed

Self Assessment customers urged to prepare and file their tax return early

The countdown clock has begun as HM Revenue and Customs (HMRC) reminds customers they have 100 days to file and pay their Self Assessment tax return before the 31 January deadline.

Anyone who is yet to start

HM Revenue and Customs (HMRC) reveals the top 5 reasons why people are calling the Self Assessment helpline and reminds them that they can self-serve to quickly access the information online.

More than 10,000 payments worth £12.5 million have been made through the new digital service to boost people’s State Pension since it launched in April 2024, HM Revenue and Customs (HMRC) has revealed.

With around 2,000 babies born on 26 September each year, more than any other day, HM Revenue and Customs (HMRC) is urging parents to claim their Child Benefit entitlement.

Claiming online means families could receive their first payment within just a week of their baby’s birth.

Child Benefit is worth up to £1,331 a year for the first child and £881 for each additional child.

Claims ca