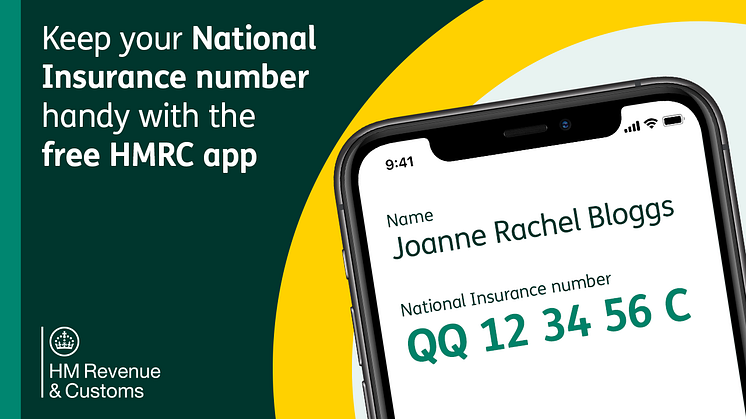

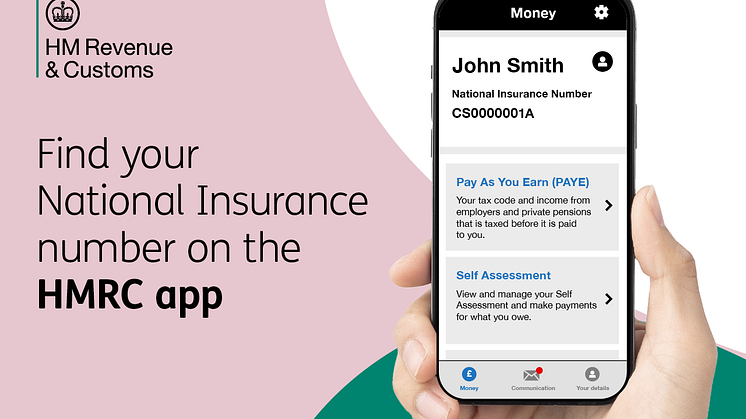

Be summer-job ready with the HMRC app

Young people finishing school, college or university and hoping to earn extra cash after their exams can download the HMRC app to get the details they need to be summer-job ready, says HM Revenue and Customs (HMRC).